If tech had a panic button, it got smashed this week.

A swirl of news stories claimed that President Trump might be preparing to block US companies from outsourcing IT work to India.

Suddenly, developers were doom-posting on Reddit, call center managers in Bangalore were refreshing Bloomberg like it was a cricket score, and startup founders were calculating what their next AWS bill might look like without India’s low-cost workforce.

The idea of banning outsourcing sounds almost cartoonish at first. “Make Call Centers American Again” doesn’t exactly roll off the tongue, but it has already turned into a political slogan online.

Still, behind the memes and the headlines lies a serious question: what happens if the US really pulls the plug on the world’s biggest outsourcing pipeline?

This isn’t just a rumor anymore.

The noise has grown louder, with Trump allies like Laura Loomer telling the press that blocking outsourcing is on the table, while Indian media warns of tariffs as high as 25 percent.

Even if the details aren’t finalized, the fact that this conversation is happening at the highest levels of US politics is enough to cause jitters across both Silicon Valley and South Asia.

So let’s dig in.

Where did these claims start? What’s actually at stake? And if the US does slam the door on India’s IT industry, who stands ready to step into the gap?

Let's find out.

Read More: How to Find Great Developers Fast For Your Tech Startup

The Source of the Storm: Fact, Speculation, and Industry Panic

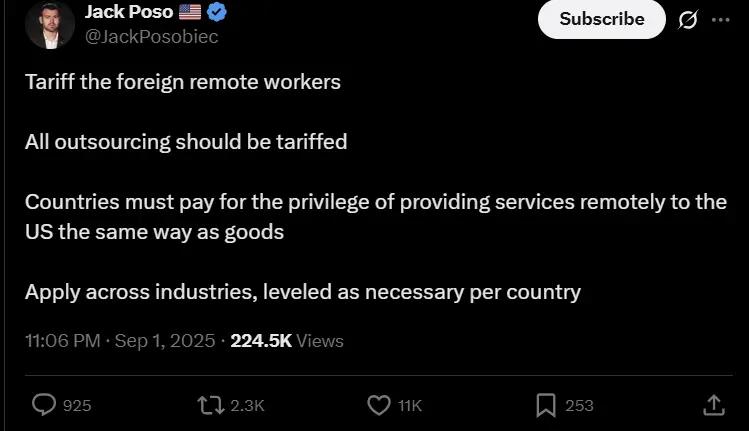

Every wildfire starts with a spark. In this case, it came from Laura Loomer, a far-right activist and close Trump ally, who posted on social media that the president was preparing to ban outsourcing to India.

Loomer framed it as payback for India’s growing ties with Russia and as a way to “bring American jobs back home.”

Almost immediately, Indian outlets like Times of India and Financial Express amplified the story.

Headlines spoke of a looming ban, a 25 percent outsourcing tax, and the possible end of India’s dominance in global IT.

Tech forums like Blind and Reddit lit up with speculation, from panicked contract workers to giddy nationalists calling it a “historic reset.”

Here’s the catch: no executive order has been signed, no bill has cleared Congress, and no federal agency has updated its rules.

Outsourcing to India is still legal and ongoing. But the storm isn’t about what’s written into law today. It’s about the credibility of the threat and the uncertainty it creates for companies that rely on predictable, low-cost outsourcing relationships.

Read More: Trump Imposes $100K on H-1B Visas: What Does It Mean for Tech Firms in the US?

Why the Panic? The Sheer Scale of India’s IT Outsourcing

The reason everyone from Wall Street analysts to Bangalore engineers is sweating isn’t because of a few tweets. It’s because India’s IT outsourcing industry has become the beating heart of the global digital economy, and the US is the blood supply.

India isn’t just another outsourcing hub. It’s the hub. For the past two decades, India has built an infrastructure, a talent pipeline, and a global brand around IT services.

Walk through Bangalore’s Electronic City or Hyderabad’s HiTech City and you see entire neighborhoods that wouldn’t exist without outsourcing contracts signed in San Francisco, New York, or Dallas.

A Workforce Built for Scale

With more than 10 million people employed in IT services and projections for 4 million new jobs by 2025, India has a scale that no other country can match.

This isn’t just about coders. It’s call centers, cloud migration specialists, cybersecurity experts, and entire product development teams.

India’s IT campuses operate like small cities, with cafeterias, shuttle buses, and power plants designed to keep global projects running 24/7.

The Money Flow

The financial footprint is equally massive. According to IMARC Group, the Indian IT outsourcing sector was worth $54.1 billion in 2024 and is projected to grow steadily to $74.1 billion by 2033.

When you count the entire technology sector, India generates about $250–283 billion annually, with exports bringing in $190–224 billion.

US Dependency

Now layer in the US factor. Somewhere between 50–62 percent of India’s tech exports go directly to the United States. That means $95–138 billion of American business is tied up in contracts with Indian vendors.

And it’s not evenly spread. Big names like TCS, Infosys, Wipro, and HCL rely on American clients for nearly two-thirds of their revenue.

So when Laura Loomer suggested Trump was about to block outsourcing, the reaction wasn’t just panic. It was a survival instinct.

Because if the US pulls back even partially, India’s IT sector doesn’t just lose revenue. Entire cities, economies, and millions of livelihoods take the hit.

What Could Actually Change? Realistic Policy Tools and Their Limits

Talk of a “ban” makes headlines, but policymaking is messier. If the Trump administration wants to curb outsourcing, it has several tools it can pull from the drawer.

Each comes with trade-offs, legal hurdles, and political consequences.

Tariffs on Outsourced Services

The loudest option is a tariff. A 25 percent tax on payments to foreign service providers has been floated in conversations around the proposed HIRE Act in Congress.

On paper, this would make offshore contracts instantly more expensive, forcing US companies to reconsider their vendor mix. But services tariffs are notoriously hard to enforce.

Unlike physical goods, IT services don’t go through ports or customs. They’re delivered over networks, billed through complex subsidiaries, and wrapped in software-as-a-service models.

Tracking and taxing every transaction would be a logistical nightmare. Add to that likely challenges at the World Trade Organization and retaliatory tariffs from India, and this option becomes politically noisy but operationally shaky.

Federal Procurement Restrictions

A quieter but more practical tool is procurement policy.

The White House could direct that all federal IT contracts be performed domestically. This wouldn’t touch private companies directly, but it would signal a clear push toward reshoring.

Over time, it could starve Indian firms of government-linked projects and force US primes like Accenture or IBM to limit offshore delivery.

Politically, this one is easier to sell. No lawsuits, no WTO fights, just a “Buy American” sticker on government IT.

Visa and Immigration Tightening

This is the old playbook. By tightening rules around H-1B and L-1 visas, the US can make it harder for Indian engineers to work onshore.

Past administrations have raised wage requirements, capped approvals, and increased compliance audits. This doesn’t directly block offshore delivery, but it disrupts hybrid models where Indian engineers rotate between US client sites and offshore hubs.

For many companies, that disruption alone is enough to make contracts more expensive and less efficient.

Executive Orders and Compliance Guidance

The fastest lever is an executive order. With the stroke of a pen, Trump could issue guidance that makes it harder for federal agencies to contract offshore or raises compliance hurdles for private firms that do.

These moves would trigger lawsuits, but they would also create immediate uncertainty. And in outsourcing, uncertainty kills deals faster than tariffs.

So while a total ban may be unrealistic, even incremental moves, tariffs, visa caps, procurement limits, could send shockwaves through India’s IT industry and force US businesses into a new sourcing strategy.

Read More: 9 Reasons Why Pakistan Is the Go-To Choice for Tech Talent Sourcing in 2025

The $138 Billion Vacuum: What Happens if the Plug Gets Pulled?

Now let’s imagine the plug actually gets pulled. What does the vacuum look like? The short answer: massive, messy, and global.

The Immediate Gap

Indian IT exports to the US are valued at $95–138 billion annually. That’s roughly 15–20 percent of the entire global IT outsourcing market.

Take that out overnight, and US businesses are left scrambling to fill a gap that no single country can absorb.

Rising Costs

Cost is the most obvious shock. Indian developers bill at $20–40 an hour. Equivalent US talent runs $80–150 an hour.

Even in alternative hubs like Eastern Europe or Latin America, rates are at least double. Industry insiders on Blind predict that software and support costs could rise 30–50 percent if India is off the table.

For startups with razor-thin budgets, that’s a death sentence. For enterprises, it’s a budget crisis.

Project Disruptions

Beyond cost, there’s execution. Thousands of contracts would need to be renegotiated or transitioned. Workflows would be interrupted. Product launches delayed. Customer support centers shut down overnight.

For industries like banking or healthcare, even a few weeks of disruption can mean compliance risks and lost trust.

Ripple Effects Across the Economy

The ripple effects don’t stop at IT firms. Consumer products, e-commerce platforms, and even government services that rely on Indian outsourcing would face higher costs and slower rollouts.

Supply chains would tighten, and global competitiveness would suffer. As one analyst put it in The Times of India:

“You don’t just move 3 million jobs like Lego blocks. If the US cuts off India, the world feels it.”

US Businesses: Facing a Strategic Crossroads

For American companies, the prospect of losing India isn’t just about cost. It’s about resilience. India has been the default outsourcing partner for two decades. Now that the default is being challenged, businesses need to rethink their playbooks.

Exploring Southeast Asia

Countries like the Philippines and Vietnam are already on the radar.

The Philippines has long dominated BPO and customer service, thanks to its English-speaking workforce.

Vietnam, meanwhile, is making big moves in software development, with growing pools of engineers billing at $18–40 an hour. Both are attractive, but neither has India’s depth of talent or infrastructure.

Turning to Eastern Europe

For advanced engineering, Poland, Romania, and Ukraine are strong contenders.

Their developers cost more, usually $40–60 an hour, but their expertise in AI, cybersecurity, and fintech makes them valuable. The trade-off is political risk and higher costs.

Nearshoring in Latin America

Mexico, Costa Rica, and Colombia offer cultural alignment and overlapping time zones. Developer rates sit between $25–45 an hour.

For US companies that want quick communication and reduced time zone friction, nearshoring is appealing. But again, scale is the challenge.

Betting on Automation

Some companies won’t move jobs at all. Instead, they’ll eliminate them. AI is already transforming customer support, testing, and routine data work.

If outsourcing to India gets pricier, automation suddenly looks cheaper. Gartner predicts that by 2026, automation could replace up to 30 percent of low-value outsourcing tasks in sectors like QA and BPO.

The crossroads are clear: diversify outsourcing across multiple countries, invest in automation, or swallow higher costs at home. None are painless, but they’re all better than waiting for the next policy shock.

Pakistan Steps Into the Spotlight for All the Right Reasons

While many countries are scrambling to pitch themselves as the “next India,” Pakistan is already quietly scaling its tech industry and attracting global attention. This moment could push it into the spotlight.

Not because it wants to replace India overnight, but because it has been quietly building a credible IT ecosystem that is now ready for international attention.

For US businesses staring at a possible $138 billion vacuum, Pakistan represents an intriguing mix of affordability, talent, and growth momentum.

Pakistan’s Growing Position

Pakistan’s IT services market is not a newcomer—it has been on a steady climb for years.

The sector is projected to grow by 7.41 percent between 2025 and 2029, reaching $3.5 billion in market volume by 2029. Within that, IT outsourcing alone is forecasted to grow even faster, at 10.88 percent annually, hitting around $1.2 billion by 2029.

These growth rates tell a clear story. While the scale is still far smaller than India’s, the momentum is undeniable.

Pakistan’s IT exports already touched a record $3.8 billion in FY2024–25 (Business Recorder), and the client base is diversifying across the US, UK, Middle East, and beyond.

Well-established vendors like 10Pearls, Systems Limited, Folio3, NetSol, TRG Pakistan, Ovex Tech, and LMKR are delivering services to global brands.

Pakistan’s startup scene is also earning recognition, with fintechs and SaaS companies raising international investment and, in 2023, Pakistani IT firms taking home eight awards at the Asia-Pacific ICT Alliance (APICTA) Awards.

This isn’t the profile of a market waiting to be discovered. It’s the profile of a market stepping into the global spotlight.

Competitive Advantages

Pakistan brings specific advantages that are highly relevant to US businesses exploring alternatives to India:

Cost Competitiveness

Developer rates are lower than in Vietnam and the Philippines while maintaining strong English proficiency. This gives Pakistan a pricing edge without compromising communication.

Time Zone Flexibility

Located at a strategic midpoint, Pakistan offers working-hour overlap with both Europe and the Middle East. For US clients, late-night and early-morning crossovers mean smoother collaboration than many Southeast Asian markets.

Government Support

The Pakistani government is actively promoting IT exports, offering tax incentives, setting up IT parks, and investing in infrastructure. Export-oriented policies create a friendlier environment for international clients.

Infrastructure Improvements

With cloud services, remote collaboration platforms, and faster broadband penetration, tapping into Pakistan’s workforce no longer requires a heavy physical footprint. Virtual delivery models have lowered entry barriers significantly.

Market Opportunity Sizing

The math here is compelling. Pakistan’s outsourcing market sits around $1.2 billion, but if even 1–2 percent of the displaced Indian outsourcing business shifts, Pakistan’s IT industry could triple overnight.

Where Pakistan can shine immediately is in software development, QA testing, DevOps, and BPO operations.

These are roles where talent is readily available and can be scaled with the right recruitment pipelines.

The strategy for US companies isn’t to dump billion-dollar contracts in Karachi tomorrow, but to start with pilot projects, build confidence, and grow systematically.

Read More: Why Pakistan is the Top Choice for Tech Talent Sourcing

epicX: Moving Beyond Outsourcing Into Strategic Partnerships

Amid all this change, one question keeps coming up: how do US companies actually make the move into Pakistan or other emerging markets without getting lost in red tape or overwhelmed by risk?

That’s where companies like epicX come in.

epicX isn’t positioning itself as just another outsourcing agency. It’s pitching itself as a strategic partner that helps US businesses not just hire developers, but set up entire offshore operations smoothly.

1. The Full-Service Partnership Model

epicX is not pitching itself as a cheaper alternative to its competitors/alternatives in India.

It’s pitching itself as a smarter technology partner. That means going beyond traditional outsourcing into business services that US companies desperately need right now:

- Legal Entity Formation

Helping US clients set up subsidiaries in Pakistan, manage local compliance, and navigate regulations.

- Infrastructure Management

Handling everything from IT infrastructure to office space, security, and day-to-day operations.

- Talent Services

Running recruitment, payroll, HR, and retention programs for clients who want stable teams without administrative hassle.

- Cultural Integration

Providing training and support to ensure cross-border teams align on communication and work styles.

2. Build-Operate-Transfer (BOT) Model

One of epicX’s strongest offerings is the BOT model.

In this setup, EpicX builds and operates an offshore delivery center on behalf of a client. Once the operation is stable and successful, EpicX transfers ownership.

This gives US businesses a low-risk entry into Pakistan. They can test the waters, scale up, and eventually own the operation without navigating the complexities of foreign expansion alone.

3. Compliance and Security Differentiation

epicX invests heavily in compliance certifications like SOC2 and ISO 27001, signaling to US companies that it can handle sensitive data securely.

Many vendors in emerging markets lack this level of investment, which gives epicX a clear edge in attracting enterprise clients.

4. Realistic Market Entry Strategy

epicX isn’t promising to replace Indian giants overnight. Instead, it’s advocating a phased approach:

- Pilot Programs: 90-day managed teams of 3–5 developers, with guaranteed replacements and measurable results.

- Reference Building: Focus on a few high-quality case studies to win trust from larger clients.

- Gradual Scaling: Expand capacity step by step, ensuring infrastructure and compliance keep pace with demand.

5. Revenue Models That Make Sense

epicX builds stability through multiple revenue streams:

- Setup fees for business establishment and infrastructure

- Monthly retainers for management and compliance

- Revenue sharing models tied to client success

- Talent placement fees for recruiting specialized teams

6. Honest Acknowledgment of Limits

epicX and many such companies know that they can’t immediately compete with India’s scale.

But it also knows that’s not the point. The goal is to carve out specific niches, software development, QA, DevOps, prove value, and then expand.

Building a reputation with US enterprises will take time, investment, and consistency.

But with the right positioning, epicX can establish itself as the go-to partner for businesses seeking stability, flexibility, and cost-effectiveness outside of India.

Key Takeaways for Stakeholders

For US Businesses

The conversation has highlighted dangerous over-concentration in outsourcing relationships. Even without policy changes, developing alternative vendor relationships and multi-shore strategies reduces risk and potentially improves negotiating positions with existing providers.

For Emerging Markets

Countries like Pakistan, Vietnam, and others have a window of opportunity to capture market share, but success requires realistic capability building rather than overselling current capacity.

For Service Providers

Companies like epicX can differentiate through comprehensive partnership models rather than competing purely on cost, but must invest in infrastructure, compliance, and credibility building.

The Pakistan Opportunity in Context

Pakistan represents one viable alternative among many in a diversifying market. Success requires:

- Realistic assessment of current capabilities and limitations

- Investment in infrastructure, security, and compliance

- Focus on specific service niches rather than attempting to replicate India's full spectrum

- Patient relationship building with US enterprises

- Systematic scaling based on demonstrated performance

The potential rewards are significant. Even capturing a small percentage of displaced Indian business would transform Pakistan's IT industry, but sustainable success requires building genuine capability rather than relying solely on opportunity.

Final Perspective

Whether Trump implements Indian IT restrictions or not, the global outsourcing landscape is evolving toward greater diversification, regional specialization, and risk-conscious vendor selection.

Companies that prepare now for this more complex environment, whether as buyers or sellers of outsourced services, will be better positioned regardless of specific policy outcomes.

The $138 billion question isn't just about Trump and India; it's about how global technology services will be delivered in an increasingly multipolar world where geopolitical considerations influence business decisions.

The companies that adapt to this reality will thrive, while those that assume historical patterns will continue unchanged risk being caught unprepared.

This analysis is based on publicly available information and industry reports. Business decisions should consider multiple factors and current policy developments beyond the scope of this article.