TL;DR

- Senator Bernie Moreno introduced HIRE Act 2025 with 25% excise tax on US outsourcing payments to foreign providers

- Combined with lost tax deductions, this increases effective outsourcing costs by approximately 58-85%

- India's $100 billion IT export industry faces biggest threat, while emerging markets may benefit from diversification

- Act currently blocked by Senate Democrats but remains under discussion with uncertain passage timeline

- Companies with flexible offshore partnerships and scalable delivery models like epicX remain well-positioned to adapt through contract adjustments while maintaining competitive rates

As if Trump's $100,000 H-1B visa fees and tightened immigration policies weren't enough for America's tech industry, US lawmakers have now presented a legislative curveball that could reshape global outsourcing. Some say it will protect American jobs while others term it as a protectionist overreach that threatens innovation.

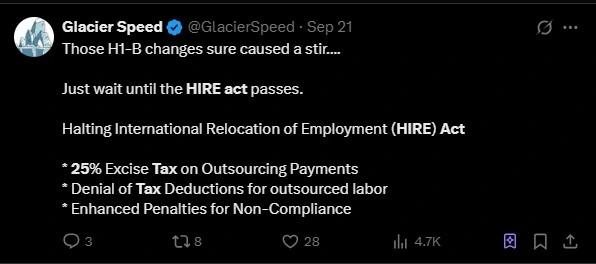

The HIRE Act 2025 isn't just another policy proposal gathering dust in congressional committees. Senator Bernie Moreno's bill proposes a 25% excise tax on every dollar US companies send to offshore service providers.

We're talking about India's $100 billion IT export engine, Pakistan's growing tech sector, and dozens of other countries that power American innovation from thousands of miles away.

The stakes couldn't be higher. American companies that built their competitive edge on global talent arbitrage now face a fundamental cost structure change.

Offshore providers who spent decades building US client relationships suddenly need to justify their value proposition against a 25% tax headwind.

So how will this reshape the global tech landscape? And which players are positioning themselves to win in this new reality?

What is the HIRE Act 2025?

Senator Bernie Moreno from Ohio introduced the Halting International Relocation of Employment Act with a simple but powerful goal: make outsourcing expensive enough that U.S. companies will choose to hire American workers instead. Though straightforward in concept, the bill carries deep implications for global tech outsourcing.

The Core Provisions

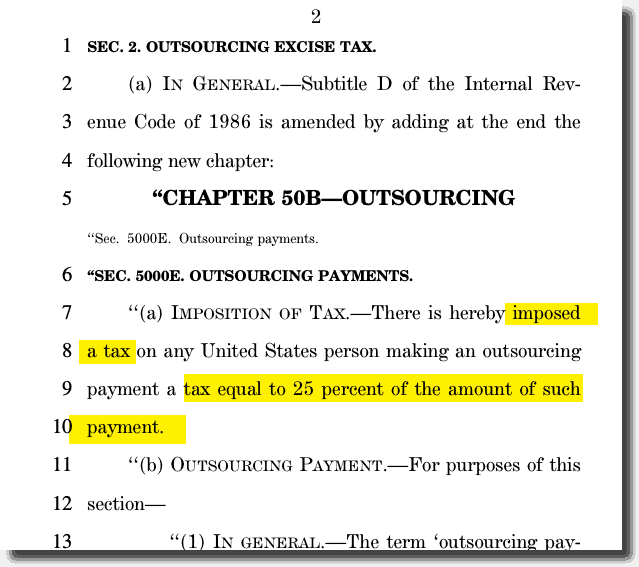

- The bill imposes a 25% excise tax on payments U.S. companies make to foreign service providers delivering services benefiting U.S. consumers.

- This tax applies to fees, royalties, service charges — essentially any outsourcing payment crossing borders.

- On top of that, companies cannot deduct these outsourcing payments from their corporate taxes, effectively increasing the outsourcing cost by an estimated 58% to 85%, depending on the business tax rate.

- The money collected from the tax funnels into a newly created Domestic Workforce Fund to finance apprenticeships, skills training, and workforce development programs aimed at boosting American employment.

- The bill is broad in coverage, affecting IT services, software development, customer support, back-office operations, and any outsourced service work benefiting U.S. entities.

- This means payments made to Indian IT firms, Pakistani developers, Eastern European engineers, and other foreign providers all face the levy if their work serves American consumers.

Read More: Trump Imposes $100K on H-1B Visas: What Does It Mean for Tech Firms in the US?

What is the 25% Excise Tax for Outsourcing Work?

The excise tax is a flat 25% levy on every dollar US companies pay offshore service providers that deliver services benefiting U.S. customers. Crucially, it is not a profit tax or savings percentage; it's a tax on gross payments.

For example, if a U.S. company pays $1 million annually for offshore development or support services, it will owe an additional $250,000 in excise tax to the U.S. Treasury — an immediate cost increase that ups pressure on margins and outsourcing viability.

Outsourcing Tax Payments Are Not Tax-Deductible

Unlike most business expenses, outsourcing payments affected by the HIRE Act cannot be deducted from taxable income. This means companies pay taxes on these payments as if they were income, doubling the financial burden.

This policy magnifies the cost impact of the excise tax, forcing companies to rethink outsourcing contracts, pricing, and delivery models urgently.

Domestic Workforce Fund to Collect These Taxes

The revenues collected from the excise tax will be allocated to the Domestic Workforce Fund. This fund is designed to support American workers by financing apprenticeship programs, workforce development initiatives, and grants aimed at communities impacted by job offshoring.

The intent is clear: tax dollars generated from offshore outsourcing will directly fund programs that reskill and equip the U.S. workforce to replace jobs lost to outsourcing.

25% Excise Tax: How It Works

The HIRE Act 2025 proposes a 25% excise tax on payments made by U.S. companies to offshore providers for services that benefit U.S. consumers. This tax applies broadly, covering fields like:

- IT services

- Software development

- Customer support and helpdesk operations

- Data processing and back-office work

Importantly, the tax is levied on total payments, not profits or savings companies might get from outsourcing. This means companies pay 25% of their gross outsourcing spend as an additional tax.

Due to this, U.S. companies facing this levy may need to restructure contracts with offshore partners or adjust delivery models to absorb or share these extra costs, potentially passing them onto clients or consumers.

Potential economic impact:

- Firms heavily reliant on offshore work could see costs increase by up to 85% once combined with loss of tax deductions.

- Indian IT companies, which earn major revenue from U.S. clients, could experience significant pricing pressure, forcing a reconsideration of service models or diversification.

Read More: Is Trump Considering Blocking IT Outsourcing to India? What It Means for the Global Tech Supply Chain

Current Status of the HIRE Act 2025

The HIRE Act is currently introduced in the Senate and is undergoing committee discussions. The bill has gained attention for its ambitious approach but sparked divided reactions.

Supporters argue:

- The bill will protect domestic jobs and create incentives to develop U.S. tech talent.

- It will fund workforce development programs through the Domestic Workforce Fund, supporting apprenticeships and skills training in impacted communities.

Critics counter:

- The tax could hurt the competitiveness of U.S. companies internationally by raising operational costs.

- It may lead to increased costs for global projects, slowing innovation cycles and causing supply chain disruptions.

The legislative timeline remains uncertain, with passage potentially taking months or longer. Amendments, compromises, or even delays remain possible as stakeholders negotiate terms.

Will the HIRE Act 2025 Pass? What Are the Chances?

The political landscape for the HIRE Act is mixed:

- Support in Congress exists among lawmakers focused on job protection and domestic workforce interests.

- However, there is significant industry pushback from U.S.-based tech firms and offshore providers.

Industry reactions include:

- Indian IT firms have escalated lobbying efforts to influence U.S. legislators, warning of severe disruptions to the outsourcing ecosystem.

- U.S. tech companies express concern over the potential for cost inflation, decreased competitive agility, and slower innovation cycles due to increased outsourcing expenses.

The most likely outcome, even if the bill passes, is phased or negotiated implementation, with provisions adjusted to mitigate the most disruptive effects.

Implications for Offshore Tech Outsourcing Markets

India

India’s $100 billion IT export industry is expected to face significant disruption if the HIRE Act 2025 passes. The 25% excise tax will increase costs for U.S. clients outsourcing work offshore, leading to reduced demand and increased pricing pressures for Indian IT service providers.

Long-term contracts may be reconsidered or renegotiated, causing uncertainty across the sector. Firms will likely accelerate shifts toward automation, nearshoring, fixed-price contracts, and diversification of client geographies.

Emerging Markets

United Kingdom & Eastern Europe

These regions are emerging alternatives but face challenges related to geopolitical instability and rising labor costs. The HIRE Act’s tax may push U.S. companies to consider these markets, but such geopolitical risks and comparatively higher wages pose barriers.

Latin America (LATAM)

LATAM offers strong tech talent with benefit of geographic proximity and time zone alignment with the U.S. However, labor costs are higher than in India or Pakistan, making it a partially effective but costlier alternative.

Pakistan

Pakistan is gaining attention for its growing pool of high-quality tech talent, competitive pricing, and mature offshore delivery models with structured remote teams.

Rather than competing solely on cost, Pakistan’s IT workforce is recognized for strong technical skills, cultural fit, and innovation capabilities, positioning it well to absorb some demand shifts.

Read More: Why Pakistan is the Top Choice for Tech Talent Sourcing

What Type of Companies Will Be Best Positioned If This Act Passes?

Companies with highly integrated offshore teams, flexible and transparent contracts, and efficient remote working infrastructures will be better prepared to absorb the additional 25% levy without disrupting service quality.

- Providers who manage distributed teams with strong communication and project management will maintain reliability.

- Companies delivering high-value technical expertise rather than just low-cost labor will retain competitive advantages.

- Firms with scalable delivery models and hybrid staffing (mix of onshore and offshore talent) can adjust contracts with minimal client impact.

- Those that prioritize client collaboration and cultural alignment will sustain long-term partnerships despite regulatory changes.

epicX and Thier Competitive Positioning

epicX exemplifies the type of offshore partner well-positioned to thrive amid the HIRE Act’s challenges. By focusing on top-tier talent from Pakistan, agile contract structures, and scalable remote delivery, epicX enables U.S. clients to navigate cost pressures while benefiting from innovation and quality.

- Leverages Pakistan’s top 5% tech talent pool known for technical excellence.

- Offers custom team augmentation models that adapt contracts as needed.

- Emphasizes transparency and communication to align client goals with offshore delivery.

- Helps businesses diversify workforce and reduce dependency on single geographic hubs.

- Maintains pricing models competitive with partially onshore alternatives, absorbing tax impacts efficiently.

Next Steps: What to Expect for HIRE Act 2025

- U.S. companies must audit existing outsourcing relationships to understand their exposure and estimate potential tax liabilities.

- Explore diversification of offshore partnerships beyond India to emerging tech hubs like Pakistan and LATAM for risk mitigation.

- Invest in distributed team infrastructure, streamlined workflows, and remote project management tools to boost efficiency.

- Stay alert on legislative developments to respond to amendments, delays, or enforcement guidelines.

- Focus on delivering deep quality, reliability, and innovation over cost-cutting, as these will be crucial to maintaining competitive edge under new cost structures.

Final Word

The HIRE Act 2025 could dramatically reshape offshore outsourcing markets, with India’s $100 billion IT export sector facing its biggest challenge in decades.

As companies reevaluate partnerships and contract terms, emerging markets like Pakistan, Latin America, and selective European hubs may gain a competitive edge.

Offshore providers who maintain strong delivery frameworks, prioritize technical excellence, cultural synchronization, and contractual flexibility will remain viable partners.

Strategic adaptation, diversification, and focus on high-quality talent and reliable delivery will be critical for companies seeking to maintain access to global tech expertise without sacrificing innovation or service standards.

FAQs About the HIRE Act 2025

Who will the 25% levy impact?

The tax will impact new payments made by U.S. companies to offshore service providers for any work benefiting American consumers.

Are existing contracts affected?

Likely only new payments made after the act’s enactment date would be subject to the levy; existing contracts may be grandfathered or renegotiated.

Will Indian IT companies be hit the hardest?

Yes, India is the largest hub for U.S. outsourcing, so many Indian IT firms will face significant cost and pricing pressure as a result.

Does this make other countries more attractive?

Yes, markets such as Pakistan, Latin America (LATAM), and the UK/Eastern Europe may see rising demand from companies diversifying their offshore sourcing.

Can offshore companies absorb this levy?

Firms with scalable operations, strong project management, and flexible contracts may absorb the costs with minor pricing or contract adjustments.

When will this take effect?

If passed, a phased implementation or grace period is possible, but the legislative process remains ongoing with no fixed timeline.

How does this affect global tech competitiveness?

The tax could raise operational costs, slowing U.S. innovation cycles and triggering shifts of tech development further abroad or to emerging markets.